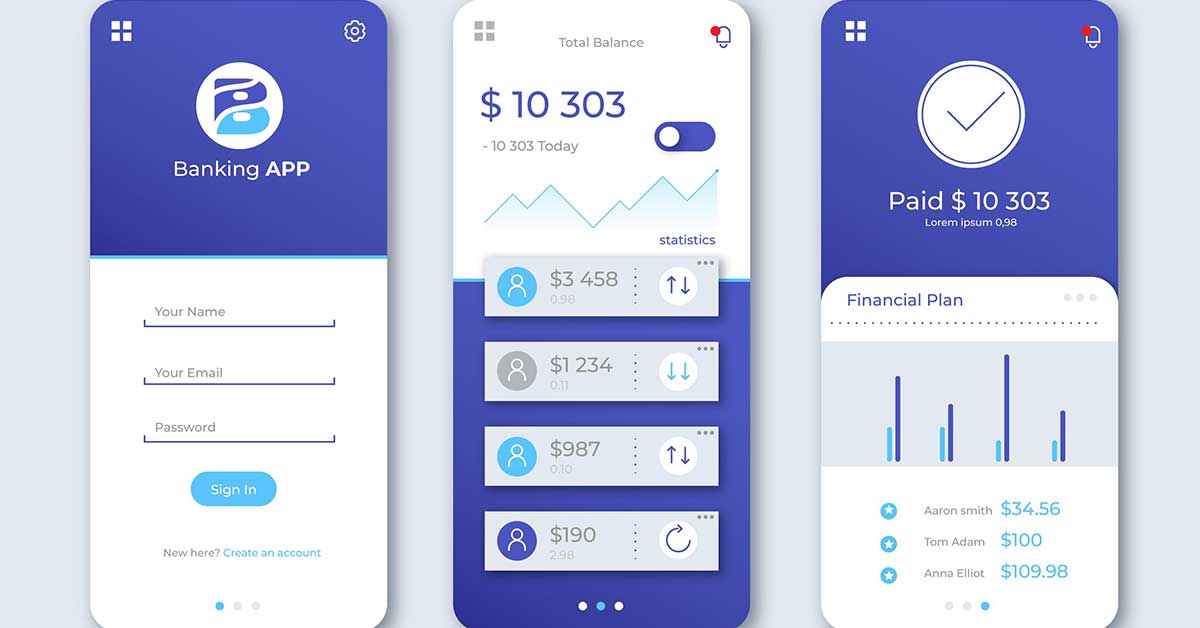

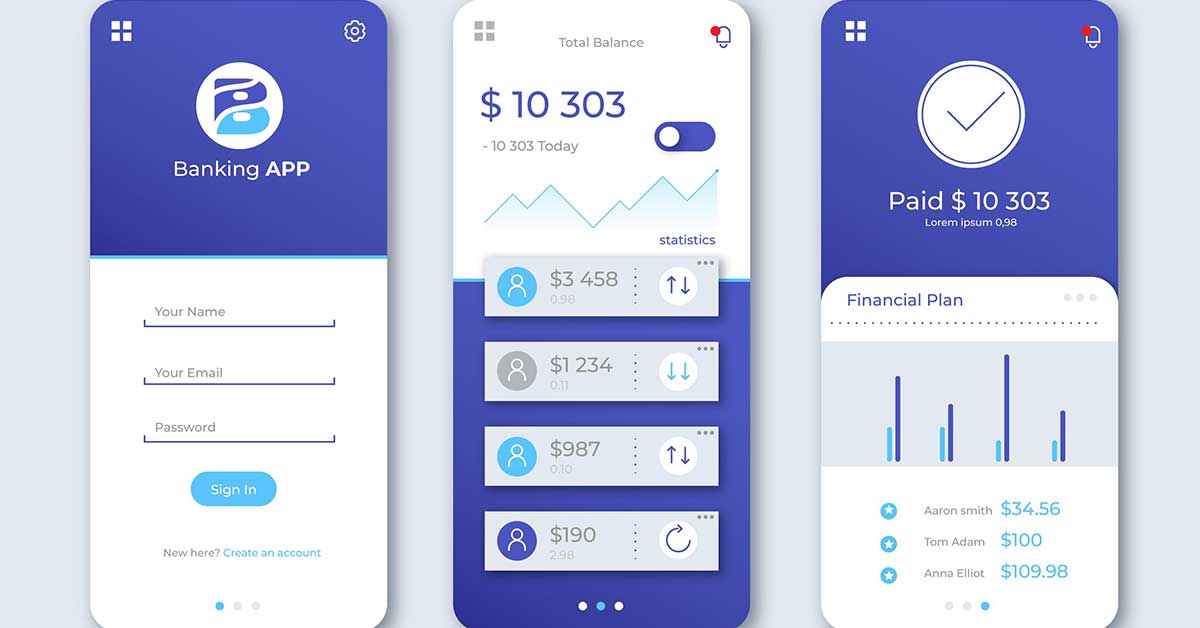

If you are someone like me who always wonders where their money goes, it is probably time you got a budgeting app. Budgeting can be hard if all you do is spend your wage once you receive it. Furthermore, the cost of living crisis makes it even harder for people to budget. They are finding it hard to save money as well as enjoy their life by going on holidays and buying new clothes. Luckily for you, many different budgeting apps can help you start earning money.

You Need a Budget

It is one of the best budgeting apps, if not the best on the market. It has a great system in place to ensure that every dollar you have has a job. It also uses your income and makes you allocate where all of your money goes. That includes your bills, savings pots, and money to enjoy yourself.

When budgeting with this app, it teaches you a lot of things. It teaches you commitment and perseverance with your money. It also helps you manage your money a lot better, especially for those who spend their paycheck and counting down the days for the next one. Not to mention the assistance it provides you if you are in debt.

On iOS, this app receives 4.8 stars out of 5. This app is a paid subscription but, you can have a free 34-day trial to test its features and see if it is worth the money. Nevertheless, this app is worth every cent.

Mint

The next app which helps with budgeting is Mint. This one is easier to use as it connects all of your bank accounts to one platform. That includes your personal bank account, your credit card accounts, investment accounts, and even your accounts for loans. As you can see your money in one place, it makes it easier to manage your cash flow and expenditure.

One of the budgeting features on this fantastic app allows you to set savings goals where you can track your progress. Another positive about Mint is that it will look for areas where you can save money. Plus, it will send you alerts if any of your bills have changed recently.

This app also receives a fantastic rating on the AppStore, with a 4.8 out of five. The best thing about this application is that it is available for free. So you don’t need to worry about paying any extra costs during the year.

Chip

Now we move to the best budgeting apps in the United Kingdom and the first one is Chip. This app offers savings accounts with a 3.82% interest rate. Like most budgeting apps, it also allows you to invest in the stock market which is another great way of saving.

Chip is a free-to-use app with most of its features however, there is a premium account version that costs £4.99 per month, less than a Spotify subscription. There are many wonderful features with this app as well. One of them is that it calculates how much you can afford to save without having an impact on your daily expenditure.

Another great feature of Chip is that it shows a spending analysis, allowing you to set up saving goals. Not to mention the amazing rate for your savings account at 3.82%. Finally, Chip is also covered by the Financial Conduct Authority and the Financial Services Compensation Scheme. That means that if anything occurs to Chip, your money is protected up to £85,000.

The issue with Chip is that you can only link one bank account to this app. If you wish to automatically save money each month, you must pay for the paid version. Other than that, the app is great for helping you manage your finances.

Plum

Plum is another great app for saving money and managing your finances requiring little effort from yourself. One of the biggest positives of Plum is the feature that allows you to invest in a personal pension through the app.

There are many fantastic features on Plum, including the AI feature that it has which connects to your bank account and provides an analysis of your spending habits. The other positive of Plum is that it allows you to set money aside with a Plum Savings Account.

There are many versions of a plum account that you can have. There is the free version, the ultra account and the premium account. All of these offer different interest rates as well. The basic account is 2.75%, the ultra account is 3.05% and the premium account is 3.51%. The final positive of this app is that you are protected by the FSCS.

There are a couple of cons with Plum. Similar to Chip, you are only able to connect one bank account to the Plum App. Users have also complained that the app withdraws money from their bank accounts and puts them in their overdraft. Other than that, this app is great for managing your funds so it is certainly one to consider if you struggle to manage your finances in the UK.

Investing in Stocks With Budgeting Apps

There are many apps out there that allow you to connect your investment accounts. However, using these apps makes investing better and hassle-free. For example, they provide you with tools to see where your money goes. They give you performance reviews and help you keep on track to retire at the age you want to.

Summary

There are many things you can use to help you manage your funds however a budgeting app is one of the best ways to do this. If you want to save money, you need to use these budgeting apps to help you do so. For investing, these apps are also great for that.

We understand that some people would rather invest in the stock market themselves. However, we advise you to be careful when investing in stocks. There are many investment stocks out there so ensure you invest with a regulated broker. If you ever lose money and it is a significant amount, you can contact an

investment fraud lawyer to retrieve most of your losses.

No comments:

Ask your question here